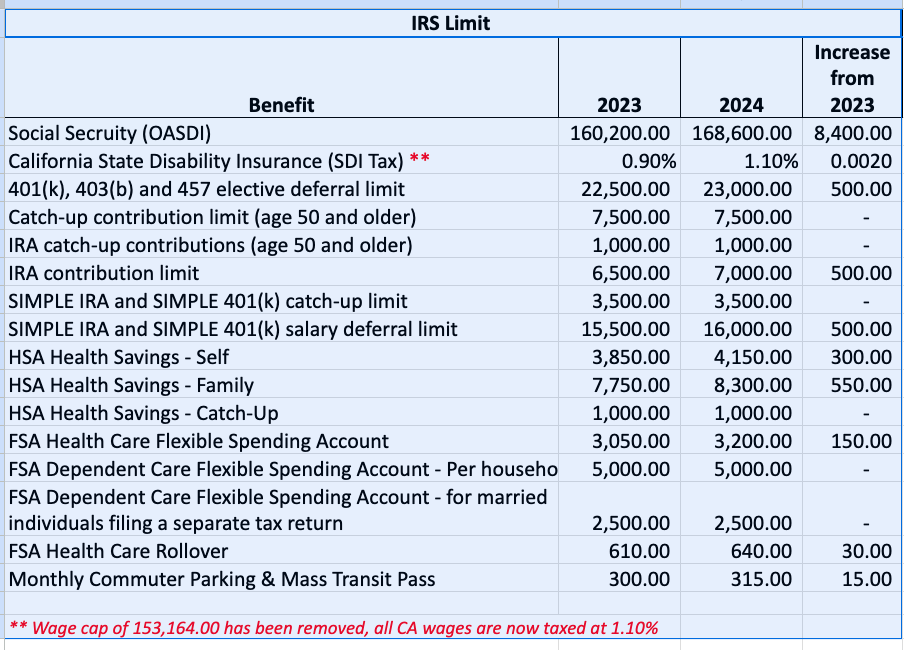

Here at Walter the Vault, we’re all about teaching families how to build a solid foundation in financial literacy and money management. Understanding the ins and outs of the IRS regulations is a crucial part of this journey. So, let’s get a quick look at what’s new, what’s changed, and what it all means for your wallet.

As part of Walter the Vault’s mission to promote financial literacy and healthy money management, we hope this chart has shed light on the important updates and changes you need to know. Remember, being in the know about IRS regulations is a vital step towards creating a healthy lifelong relationship with money. Stay tuned for more valuable insights and tips from Walter the Vault!

The holiday season is upon us, and as parents, we know that it can also be a time of increased spending. However, saving money during this festive season is not only possible but can also be a fun learning experience for your child. By involving them in the process, you can teach them valuable lessons about budgeting and resourcefulness while creating memories together. Here are easy and effective Walter the Vault recommendations to help you have holidays on a budget while including your child in each activity.

Instead of purchasing expensive holiday decorations, why not get creative and make your own? By involving your child in crafting ornaments, paper snowflakes, or a festive wreath using materials you already have at home, you not only save money but also turn it into a fun afternoon activity. Your child will love seeing their creations displayed around the house, and it’s a great way to add a personal touch to your holiday decor.

Encourage your child to channel their inner artist and create personalized gifts for family and friends. Help them make handmade cards, paint pictures, or put together a small craft project. Set up a holiday gift-making station with supplies and watch their creativity flourish. If your child is not too interested in art, you can always print out pictures and cards they can help choose. Not only is this an affordable option, but it also allows your child to experience the joy of giving and spread holiday cheer.

Who doesn’t love holiday treats? Instead of purchasing expensive goodies, why not bake your own? Look for easy and budget-friendly cookie recipes online and have your child assist you in preparing the dough and decorating the cookies. This activity not only saves money but also teaches your child valuable skills such as measuring ingredients, following a recipe, and the joy of baking. Plus, the aroma of freshly baked cookies filling your home is an added bonus!

Make finding coupons a fun treasure hunt with your child. Before you head out to shop for gifts or groceries, create a list of what you need and search for coupons together. Have your child look through newspapers, magazines, or online sources. They will feel like a little detective as they hunt for those money-saving deals. This activity not only gets them involved in budgeting but also promotes essential skills like reading and critical thinking.

Having fun during the holiday season doesn’t have to break the bank. Plan enjoyable activities for the whole family that are budget-friendly. Organize a game or movie night complete with your child’s favorite snacks. Alternatively, go on a winter hike, build a snowman, or visit local holiday displays. By emphasizing inexpensive or free activities, you can ensure that your child experiences the joy of the season without splurging on costly entertainment.

Throughout these #WalterTheVaultApproved activities, it’s important to discuss the importance of saving money with your child. Explain how being resourceful and mindful of expenses can help provide more opportunities for fun and memorable experiences. By involving your child in the process of saving, you empower them with valuable life skills and teach them the importance of financial responsibility. So this holiday season, enjoy the festivities while creating lasting memories and saving money along the way!

Happy New Year Everyone!

We’re a few weeks into 2015 so there’s no better time to start saving. One savings plan that comes to mind is the 529 Plan. With the growing costs of higher education, starting a 529 plan can help give you a head start when it comes to paying for your child’s college tuition and expenses. READ MORE

Hello Everyone,

The holiday season is upon us, which can lead to big spending. Don’t worry, here are some tips for kids to help them earn and save money during the busy season. READ MORE

Hi Everyone,

Recently Forbes published “3 Financial Goals To Focus On In Every Decade.” The article discussed goals for people 20 and over. Walter the Vault feels it’s important for children and teens to have financial goals as well. READ MORE

Hello everyone,

Summer is the prime time for families to go on day trips and vacations. Kids rarely understand how expensive these trips are, but always want to enjoy these summer experiences. One way to help children learn about basic vacation expenses is to plan the trips with them. READ MORE

Sign up for our mailing list!

Be the first to learn about

fun new games, coloring pages

and financial literacy charts.