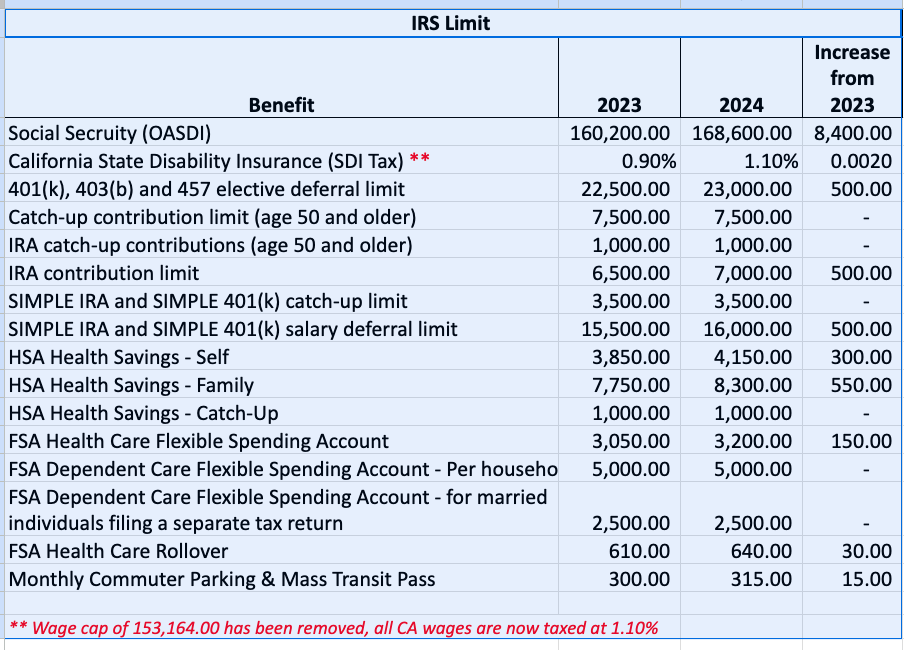

Here at Walter the Vault, we’re all about teaching families how to build a solid foundation in financial literacy and money management. Understanding the ins and outs of the IRS regulations is a crucial part of this journey. So, let’s get a quick look at what’s new, what’s changed, and what it all means for your wallet.

As part of Walter the Vault’s mission to promote financial literacy and healthy money management, we hope this chart has shed light on the important updates and changes you need to know. Remember, being in the know about IRS regulations is a vital step towards creating a healthy lifelong relationship with money. Stay tuned for more valuable insights and tips from Walter the Vault!

The holiday season is upon us, and as parents, we know that it can also be a time of increased spending. However, saving money during this festive season is not only possible but can also be a fun learning experience for your child. By involving them in the process, you can teach them valuable lessons about budgeting and resourcefulness while creating memories together. Here are easy and effective Walter the Vault recommendations to help you have holidays on a budget while including your child in each activity.

Instead of purchasing expensive holiday decorations, why not get creative and make your own? By involving your child in crafting ornaments, paper snowflakes, or a festive wreath using materials you already have at home, you not only save money but also turn it into a fun afternoon activity. Your child will love seeing their creations displayed around the house, and it’s a great way to add a personal touch to your holiday decor.

Encourage your child to channel their inner artist and create personalized gifts for family and friends. Help them make handmade cards, paint pictures, or put together a small craft project. Set up a holiday gift-making station with supplies and watch their creativity flourish. If your child is not too interested in art, you can always print out pictures and cards they can help choose. Not only is this an affordable option, but it also allows your child to experience the joy of giving and spread holiday cheer.

Who doesn’t love holiday treats? Instead of purchasing expensive goodies, why not bake your own? Look for easy and budget-friendly cookie recipes online and have your child assist you in preparing the dough and decorating the cookies. This activity not only saves money but also teaches your child valuable skills such as measuring ingredients, following a recipe, and the joy of baking. Plus, the aroma of freshly baked cookies filling your home is an added bonus!

Make finding coupons a fun treasure hunt with your child. Before you head out to shop for gifts or groceries, create a list of what you need and search for coupons together. Have your child look through newspapers, magazines, or online sources. They will feel like a little detective as they hunt for those money-saving deals. This activity not only gets them involved in budgeting but also promotes essential skills like reading and critical thinking.

Having fun during the holiday season doesn’t have to break the bank. Plan enjoyable activities for the whole family that are budget-friendly. Organize a game or movie night complete with your child’s favorite snacks. Alternatively, go on a winter hike, build a snowman, or visit local holiday displays. By emphasizing inexpensive or free activities, you can ensure that your child experiences the joy of the season without splurging on costly entertainment.

Throughout these #WalterTheVaultApproved activities, it’s important to discuss the importance of saving money with your child. Explain how being resourceful and mindful of expenses can help provide more opportunities for fun and memorable experiences. By involving your child in the process of saving, you empower them with valuable life skills and teach them the importance of financial responsibility. So this holiday season, enjoy the festivities while creating lasting memories and saving money along the way!

As fellow parents, we share a common goal – watching our children thrive and become self-sufficient in the future. However, in this consumer-driven world we live in, it’s becoming increasingly challenging to instill in them the importance of money management and wise financial choices. That’s where the power of teaching financial literacy at a young age comes into play. Join me as we dive into three vital advantages of introducing financial literacy to our elementary school-aged kids – because our children’s financial well-being matters now more than ever.

Financial literacy is the foundation upon which our children can build a secure and prosperous future. By teaching them the basics of money management and financial responsibility, we provide them with essential life skills that will serve them well throughout their lives. Just like teaching them how to read and write, financial literacy is a crucial component of their education.

Introducing financial concepts early on allows children to develop a healthy relationship with money and understand its true value. By grasping the concept of earning, saving, and spending, children become equipped to make informed decisions about their own finances later on. They develop the ability to budget effectively, set achievable financial goals, and avoid debt traps. These fundamental skills will empower our children to navigate the complex world of money with confidence and independence.

Financial literacy teaches children the importance of taking responsibility for their actions and their finances. By introducing them to basic concepts like needs versus wants, the value of delayed gratification, and the power of good saving habits, we instill a sense of accountability within them.

When children understand the value of money, they learn to make thoughtful choices while spending their allowance or managing money gifts. As they grow, this knowledge will translate into responsible decision-making regarding larger financial matters. By teaching them about the consequences of poor financial choices, we are paving the way for a financially responsible adulthood.

Visit Walter the Vault’s FREE activities section and subscribe to our YouTube channel, where you’ll find a lot of fun, interactive, and engaging activities to do at home with your kids. Let’s make learning about finances an exciting family experience!

Financial literacy empowers children to dream big and take control of their future. Understanding financial concepts at an early age helps them set meaningful goals for themselves and provides the tools they need to achieve those dreams. By learning about the power of saving, investing, and managing money wisely, children become more confident in their ability to turn their dreams into reality.

Imagine your child dreaming of becoming an astronaut, a doctor, or a business owner. With a strong foundation in financial literacy, they know how to manage their finances and make their aspirations a financial possibility. By teaching them about the value of time and compound interest, they can make informed decisions about saving for college, starting a business, or even investing in their future at a young age. Financial literacy empowers our children to make their dreams come true, no matter how big or small.

Teaching financial literacy to our elementary school-aged children is one of the greatest gifts we can give them. By building strong foundations, fostering responsibility, and empowering them to reach their dreams, we equip our children with the tools they need to thrive in an increasingly complex financial world. Sign up today for Walter the Vault’s one-on-one online 25-minute lessons and let’s embark on this financial literacy journey together!

Remember, by teaching our kids the secrets to becoming money-savvy early on we’ll be setting them on a path to financial success and independence. After all, financial literacy is the key to unlocking a bright future for our children.

Article By: Kelly Kirk-Xu

Wherever you are, whatever you’re doing – it can usually relate to money. We use money all of the time! The basics of using money are so great to start explaining to your kids.

For example, at the store, you can say: “I budgeted $20 for this trip… this bread is $3… how much do we have left to spend?” If your kids aren’t so confident in math – no problem! Grab your calculator app or a nearby pen, and write it out. This will add even more interaction and engagement (and potentially curiosity-driven fun!) to this question.

The more often you can experience positive moments related to money, the less intimidating it may be to keep learning about it. And you know what Mr. Buffett says: The more you learn, the more you earn!!

Why not let your kids be involved with the math/process behind budgeting – not to mention adding in taxes!! – this can really help your kids understand your “why” for buying (or not buying) certain items.

Of course, keep the topics within reason. We don’t need to stress the kids out! But we can tell them stories about our true personal struggles & victories related to money (in addition to our less exciting daily decision-making choices about money stories, too 🙂

Another thing you can talk about with your kids is quite basic: Money lets people trade with one another without the need for bartering… AKA money hasn’t always existed! People used to barter EVERYTHING!

Try a game with your kids: Pick up (or point out) various objects and ask, “What is fair for this?” and “What would you accept for that?” As you play this game, you can talk about the average monetary value of different things – and whether or not the price seems fair!

Take Care,

Teacher Kelly & The Walter the Vault Team 🙂

Sign up for our mailing list!

Be the first to learn about

fun new games, coloring pages

and financial literacy charts.