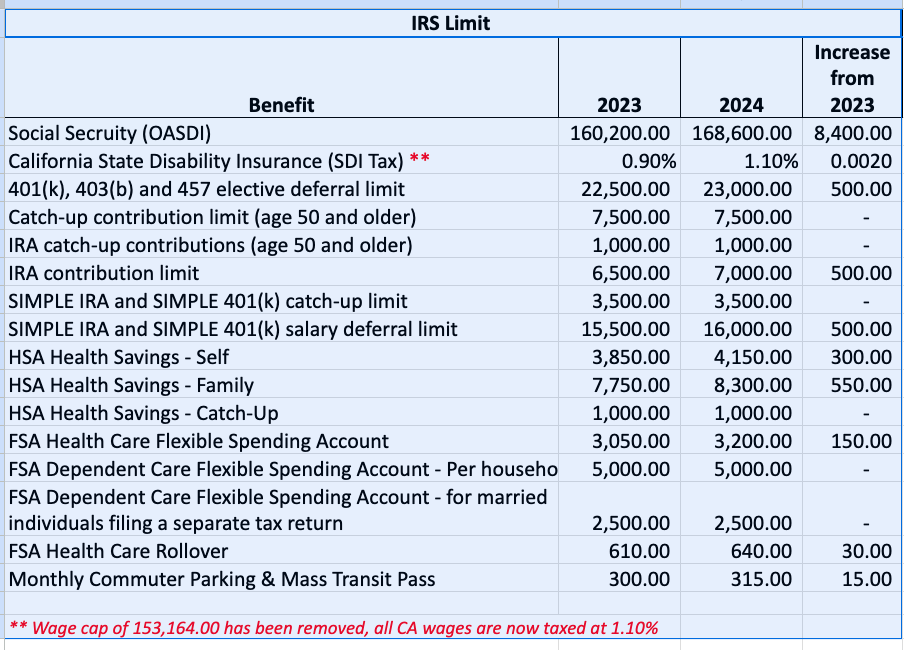

Here at Walter the Vault, we’re all about teaching families how to build a solid foundation in financial literacy and money management. Understanding the ins and outs of the IRS regulations is a crucial part of this journey. So, let’s get a quick look at what’s new, what’s changed, and what it all means for your wallet.

As part of Walter the Vault’s mission to promote financial literacy and healthy money management, we hope this chart has shed light on the important updates and changes you need to know. Remember, being in the know about IRS regulations is a vital step towards creating a healthy lifelong relationship with money. Stay tuned for more valuable insights and tips from Walter the Vault!

The holiday season is upon us, and as parents, we know that it can also be a time of increased spending. However, saving money during this festive season is not only possible but can also be a fun learning experience for your child. By involving them in the process, you can teach them valuable lessons about budgeting and resourcefulness while creating memories together. Here are easy and effective Walter the Vault recommendations to help you have holidays on a budget while including your child in each activity.

Instead of purchasing expensive holiday decorations, why not get creative and make your own? By involving your child in crafting ornaments, paper snowflakes, or a festive wreath using materials you already have at home, you not only save money but also turn it into a fun afternoon activity. Your child will love seeing their creations displayed around the house, and it’s a great way to add a personal touch to your holiday decor.

Encourage your child to channel their inner artist and create personalized gifts for family and friends. Help them make handmade cards, paint pictures, or put together a small craft project. Set up a holiday gift-making station with supplies and watch their creativity flourish. If your child is not too interested in art, you can always print out pictures and cards they can help choose. Not only is this an affordable option, but it also allows your child to experience the joy of giving and spread holiday cheer.

Who doesn’t love holiday treats? Instead of purchasing expensive goodies, why not bake your own? Look for easy and budget-friendly cookie recipes online and have your child assist you in preparing the dough and decorating the cookies. This activity not only saves money but also teaches your child valuable skills such as measuring ingredients, following a recipe, and the joy of baking. Plus, the aroma of freshly baked cookies filling your home is an added bonus!

Make finding coupons a fun treasure hunt with your child. Before you head out to shop for gifts or groceries, create a list of what you need and search for coupons together. Have your child look through newspapers, magazines, or online sources. They will feel like a little detective as they hunt for those money-saving deals. This activity not only gets them involved in budgeting but also promotes essential skills like reading and critical thinking.

Having fun during the holiday season doesn’t have to break the bank. Plan enjoyable activities for the whole family that are budget-friendly. Organize a game or movie night complete with your child’s favorite snacks. Alternatively, go on a winter hike, build a snowman, or visit local holiday displays. By emphasizing inexpensive or free activities, you can ensure that your child experiences the joy of the season without splurging on costly entertainment.

Throughout these #WalterTheVaultApproved activities, it’s important to discuss the importance of saving money with your child. Explain how being resourceful and mindful of expenses can help provide more opportunities for fun and memorable experiences. By involving your child in the process of saving, you empower them with valuable life skills and teach them the importance of financial responsibility. So this holiday season, enjoy the festivities while creating lasting memories and saving money along the way!

Hello Everyone,

Here at Walter the Vault we’ve discussed various topics about when and how to save money but we rarely talk about investing in stock. Children can not legally invest in stock on their own, but there’s still a lot to learn. READ MORE

Hi Everyone,

Tax season is nearing a close but there are still last minute tips to learn if you haven’t filed. One big question is what to do with your child’s saved and earned income?

Hopefully your child has been saving more lately. Depending on how much, they can be affected by the “Kiddie Tax.” If your child has more than $1000 in unearned income from savings interests, the income may be taxed. The rate depends on how much unearned income the child has. READ MORE

Hello Everyone,

The holiday season is upon us, which can lead to big spending. Don’t worry, here are some tips for kids to help them earn and save money during the busy season. READ MORE

Dear Friends,

Thank you for your support of my passion project, teaching children about money with Walter the Vault. Your words of encouragement and generosity is much appreciated. Unfortunately, we did not meet our target goal. READ MORE

Hi Readers,

Today is a huge day for Walter the Vault because it’s the launch of our Kickstarter campaign. With your contributions over the next 30 days we’ll be able to finance our first book The Pumpernickels Meet Walter the Vault. READ MORE

Hi Everyone,

Recently Forbes published “3 Financial Goals To Focus On In Every Decade.” The article discussed goals for people 20 and over. Walter the Vault feels it’s important for children and teens to have financial goals as well. READ MORE

Hi Everyone,

Here’s a scenario: It’s your birthday and you receive a check as a gift. What do you do with it?

Perhaps your best option if you’re under the age of 18 and don’t already have one is to open a savings account, also known as a Custodian Account. A Custodian or Custodial Account is an account created at a bank, brokerage firm or mutual fund company that is managed by an adult for a minor that is under the age of 18 to 21 (depending on state legislation). Although most custodians who manage the bank accounts are parents, guardians, or relatives, the custodian doesn’t have to be related to the child to set one up. READ MORE

Hello everyone,

Summer is the prime time for families to go on day trips and vacations. Kids rarely understand how expensive these trips are, but always want to enjoy these summer experiences. One way to help children learn about basic vacation expenses is to plan the trips with them. READ MORE

Sign up for our mailing list!

Be the first to learn about

fun new games, coloring pages

and financial literacy charts.