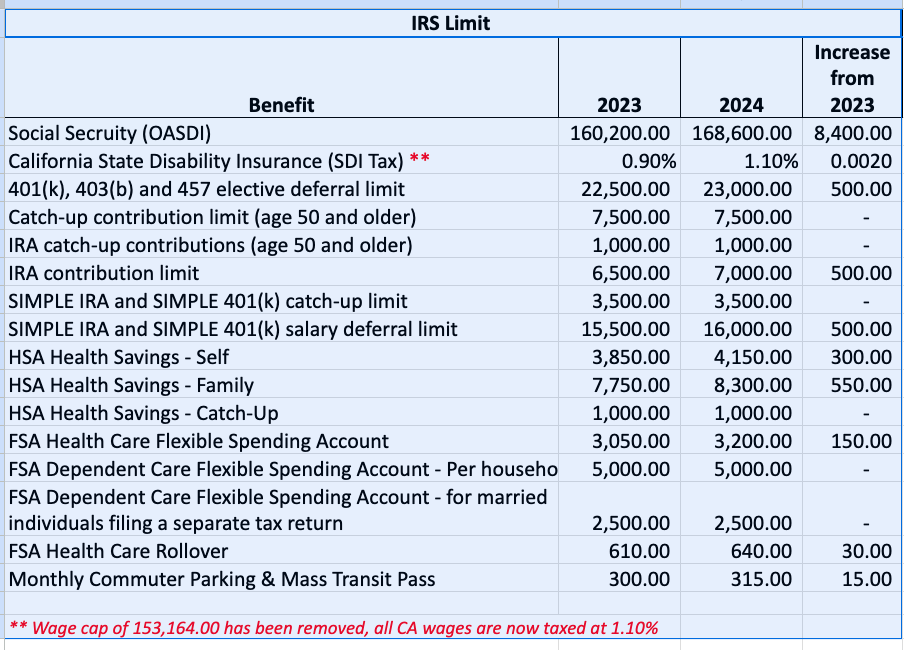

Here at Walter the Vault, we’re all about teaching families how to build a solid foundation in financial literacy and money management. Understanding the ins and outs of the IRS regulations is a crucial part of this journey. So, let’s get a quick look at what’s new, what’s changed, and what it all means for your wallet.

As part of Walter the Vault’s mission to promote financial literacy and healthy money management, we hope this chart has shed light on the important updates and changes you need to know. Remember, being in the know about IRS regulations is a vital step towards creating a healthy lifelong relationship with money. Stay tuned for more valuable insights and tips from Walter the Vault!

The holiday season is upon us, and as parents, we know that it can also be a time of increased spending. However, saving money during this festive season is not only possible but can also be a fun learning experience for your child. By involving them in the process, you can teach them valuable lessons about budgeting and resourcefulness while creating memories together. Here are easy and effective Walter the Vault recommendations to help you have holidays on a budget while including your child in each activity.

Instead of purchasing expensive holiday decorations, why not get creative and make your own? By involving your child in crafting ornaments, paper snowflakes, or a festive wreath using materials you already have at home, you not only save money but also turn it into a fun afternoon activity. Your child will love seeing their creations displayed around the house, and it’s a great way to add a personal touch to your holiday decor.

Encourage your child to channel their inner artist and create personalized gifts for family and friends. Help them make handmade cards, paint pictures, or put together a small craft project. Set up a holiday gift-making station with supplies and watch their creativity flourish. If your child is not too interested in art, you can always print out pictures and cards they can help choose. Not only is this an affordable option, but it also allows your child to experience the joy of giving and spread holiday cheer.

Who doesn’t love holiday treats? Instead of purchasing expensive goodies, why not bake your own? Look for easy and budget-friendly cookie recipes online and have your child assist you in preparing the dough and decorating the cookies. This activity not only saves money but also teaches your child valuable skills such as measuring ingredients, following a recipe, and the joy of baking. Plus, the aroma of freshly baked cookies filling your home is an added bonus!

Make finding coupons a fun treasure hunt with your child. Before you head out to shop for gifts or groceries, create a list of what you need and search for coupons together. Have your child look through newspapers, magazines, or online sources. They will feel like a little detective as they hunt for those money-saving deals. This activity not only gets them involved in budgeting but also promotes essential skills like reading and critical thinking.

Having fun during the holiday season doesn’t have to break the bank. Plan enjoyable activities for the whole family that are budget-friendly. Organize a game or movie night complete with your child’s favorite snacks. Alternatively, go on a winter hike, build a snowman, or visit local holiday displays. By emphasizing inexpensive or free activities, you can ensure that your child experiences the joy of the season without splurging on costly entertainment.

Throughout these #WalterTheVaultApproved activities, it’s important to discuss the importance of saving money with your child. Explain how being resourceful and mindful of expenses can help provide more opportunities for fun and memorable experiences. By involving your child in the process of saving, you empower them with valuable life skills and teach them the importance of financial responsibility. So this holiday season, enjoy the festivities while creating lasting memories and saving money along the way!

NADYA NATALY/HERALD

Money affects everyone regardless of age. The worry increases with age as bills and responsibility change over time. However, according to the Long Island-based financial advisors, Money Masters, Inc., conversations about money should start at an early age.

“Our goal is to raise children that grow into prosperous adults who have a healthy relationship with money,” said Richard Weinstein, co-founder of Money Masters. “We want them to have money literacy.”

On Jan. 22, the Freeport Memorial Library welcomed Weinstein to the monthly Financially Fit workshop to tackle the question, “How do parents talk to their children about money?”

Freeporters interested in mastering the sticky world of finances, while learning new ways to have conversations with their kids attended the workshop in hopes of tapping into new resources.

“I don’t think people see the need for this, but this is starting to be a topic of discussion,” Weinstein added. “Parents are reluctant to talk to the children about money because they don’t feel comfortable. It’s a void and we’re trying to fill that void.“

Weinstein is a business owner of a New York City-based electrical contracting firm for over 30 years walked, parents and grandparents, through different steps they could raise money-smart kids. Through the workshop, Weinstein introduced Walter the Vault, a cartoon character he created in efforts to help children better understand the fundamentals of money.

On the Money Masters’ website, walterthevault.com,Walter the Vault stars in a collection of games, coloring pages, puzzles and spending charts centered around spending, saving, budgeting, financial goals and earning.

According to Claire Lynch, vice president of business development at Money Masters, parents should start conversations with children at a young age in efforts to start developing a healthy relationship into adulthood. An approximate, 72 percent of parents say they’re reluctant to talk to their children about money, says Weinstein.

“It is overwhelming for parents to explain fiancés to their kids. We hope our guide can help answer parents answer their kid’s questions,” Lynch said.

Weinstein recommends parents to find ways they can teach the children how to earn money around the house by assigning chores or even shoveling snow. Another suggestion was to give the children a weekly allowance. However, the most important thing to do, says Weinstein, is to keep track of the money and store it in a safe place.

“You wake up in the morning you plan out your work day and health day,” Weinstein said. “You should put that same emphasis in your planning your financial day — what am I going to spend, earn, save or donate.”

http://liherald.com/freeport/stories/conversations-in-finances-to-teach-children,99558

“April is Financial Literacy Month. And studies show we need it more than ever, with as many as two thirds of American adults unable to answer basic financial questions.”

View Article: http://www.fox5ny.com/news/teaching-your-children-about-money

It is important to be fiscally responsible in order to succeed in the adult world. Thus, teaching children the importance of finances from the time they are young will likely have positive effects on their futures. Even though math-related subjects can be perceived as boring, complicated and even intimidating, a few enterprising individuals have created ways to teach children financial lessons in a fun and entertaining way. “Walter The Vault” is an example of such character-driven, finance-focused, entertainment-education. READ MORE

Sign up for our mailing list!

Be the first to learn about

fun new games, coloring pages

and financial literacy charts.